Mutual Funds: Meaning, Advantages & Disadvantages

MEANING OF MUTUAL FUNDS

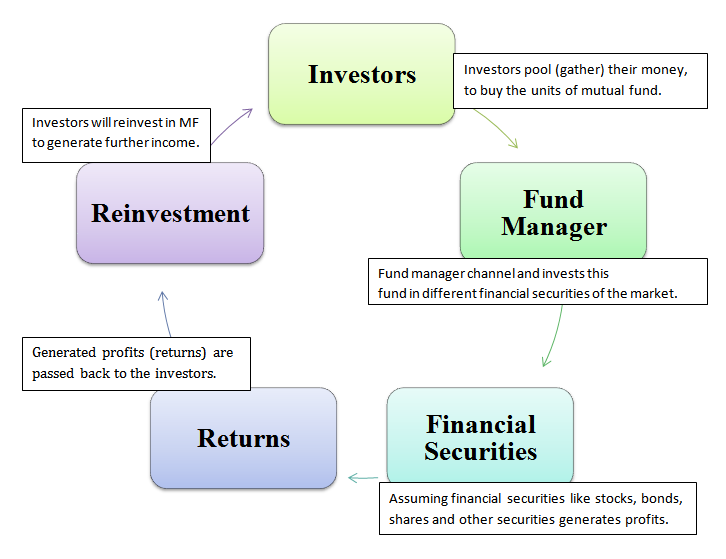

Mutual funds are referred to the investment vehicles which pool money from various investors and invest the same in the stock markets. Investing in a mutual fund allows an investor to add a substantial number of stocks in his/her portfolio for a comparatively lower cost than purchasing such stocks individually. Mutual funds are a kind of investment where investors accumulate their financial resources together for investing in diversified assets class. When a person invests in a mutual fund, he/she does not get any ownership of the assets in the portfolio. Instead, he/she becomes the owner of a unit of the mutual fund. The most common types of mutual funds are stocks, bonds, and other money market assets. There are different advantages and disadvantages of investing in mutual funds.

ADVANTAGES OF Mutual Funds

1) Liquidity: Liquidity refers to the ease of converting one’s assets into cash. Mutual funds are considered as liquid assets because they have high demands in the marketplace. Therefore, an investor can conveniently convert the asset held by him/her to cash selling it to an another investor.

2) Professional Management: Mutual funds are managed by skillful and knowledgeable fund managers. Therefore, an inexperienced investor is not required to worry at all who is looking to invest in the mutual funds maximize his/her financial goals.

3) High returns: One can get high returns by investing in growth funds. The returns are associated with the growth of the company. Apart from that, an investor also gets attractive dividends and share in capital gains from investing in some mutual fund.

4) The benefit of diversification: Mutual funds allow anyone to invest in a diversified portfolio. The investors invest in a diversified portfolio as because it enhances the expected returns while at the same time it minimizes the risk.

Cons OF MUTUAL FUNDS

1) Risk: Mutual fund investments are subjected to market risks. The Net Asset Value (NAV) of the units of a fund depends on the performance of the companies on whom the mutual fund company has invested the money pooled from the investors.

2) Fees: The fees that are charged from the investors depend on the type of mutual fund bought. If a fund is risky and aggressive, the management fee is expected to be on the high side. Apart from this, the investor is required to make payment for taxes, transaction fees including other costs in order to maintain the fund.

3) Premature surrender charges: If an investor wants to liquidate his/her fund before the maturity, he/she is required to pay for availing such facility.

4) Loss of Control: The fund managers take the decisions regarding which securities to buy and which securities to sell and when to do such things. The investor has to should remember that he/she is trusting someone else with his/her money when he/she invests in a mutual fund.

Verdict

To enter into the world of mutual fund investing, one requires first analyze his/her own situation, specifically, his/her financial needs and goals. An individual has to determine what he/she is investing for and his/her comfort with risk so as to assess what kinds of funds he/she should look at.